When buying a property in France, as with anywhere, you should make sure you factor in fees and charges that you will need to pay at the point of purchase into your budget. You need to be aware of when these monies are due so that you have the necessary funds, exchanged into the right currency, available in plenty of time.

Once your offer has been accepted, you will sign the Compromis de vente and will need to pay your deposit. This can be up to a maximum of 10% of the property price. You should transfer this money in cash or cheque form to the solicitor (Notaire) in charge of the sale rather than to the vendor and then it is held securely until you complete on the property and all searches have been conducted satisfactorily.

You will also need to pay legal fees, which can be up to 8% of the purchase price for older properties and 4% for brand new properties. These are payable upon completion of the sale.

Estate agency fees of between 5 and 10% can be payable and unfortunately it depends on a case by case basis whether the buyer or vendor pays these fees. If you're living in France and taking out a French mortgage, you are a French resident for tax purposes. This means you can raise up to 100% of the purchase price with a mortgage.

If you're a tax payer in another EU country you can raise up to 85% and if you're a tax payer elsewhere you can raise up to 80% of the purchase price by way of a French mortgage. You will also need to pay an arrangement fee of around 1% of the mortgage amount. Bear in mind that the UK and France have a double taxation treaty, meaning you should only be paying tax in one country, not both.

If you do take out a mortgage in France you'll need life assurance to secure the loan and this can either be arranged with the lender when you take out your mortgage, or you can take out an independent policy. Generally speaking a life assurance policy will be medically underwritten so if you're in good health and lead a healthy life the payments will be lower.

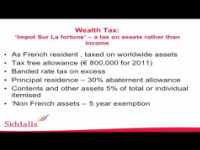

Once you own your property, don't forget you'll have to pay French income tax on any rental revenue made on your property in France, possibly a wealth tax as well as French inheritance tax when the property passes to your children.

Read our guide to buying a property in France or search properties for sale in France.

Videos featured in this article